Last month CMS published statistics on appeals of RAC repayment demands. According to CMS, between October 1, 2010 and September 30, 2011, the RACs determined that 903,372 claims had been overpaid. During that period, providers filed appeals from 56,620 of these repayment demands. Separately, CMS says that for appeals decided during the same period, the RAC’s repayment demands were overturned in 24,548 or 43.4% of the decided appeals.

Last month CMS published statistics on appeals of RAC repayment demands. According to CMS, between October 1, 2010 and September 30, 2011, the RACs determined that 903,372 claims had been overpaid. During that period, providers filed appeals from 56,620 of these repayment demands. Separately, CMS says that for appeals decided during the same period, the RAC’s repayment demands were overturned in 24,548 or 43.4% of the decided appeals.

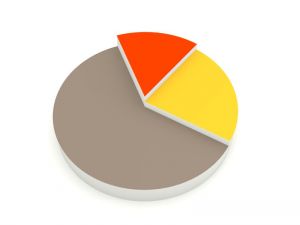

The CMS statistics indicate that 31,297 or 55.3% of the appeals were from automated reviews and 22,188 or 39.2% of the appeals were from complex reviews. CMS was unable to identify the type of review from which the remaining 3,135 or 5.5% of the appeals were filed.

CMS also sorted the claims by provider type. Of the 903,372 claims that the RACs alleged were overpaid, 197,739 or 21.8% came from Part A providers, 410,208 or 45.4% were submitted by Part B providers and 295,425 or 32.8% originated with DME providers. During FY 2011, CMS’s statistics indicate that Part A providers appealed 13.7% of the repayment demands while Part B and DME providers appealed 4.9% and 3.1% respectively of the RAC’s repayment demands.

Why did CMS publish this report?

From its inception, providers have been justly concerned that because the RACs are being paid a contingent fee for their work, they would demand repayment of large numbers of perfectly proper claims. To demonstrate that this is not the case, CMS has published a number of reports on provider appeals in an attempt to demonstrate that the overwhelming number of RAC repayment demands are justified and that providers should have no concern that the RACs are lining their pockets with provider money. To justify this position, CMS points to this latest report concluding that only 2.7% of the RAC repayment demands for FY 2011 were overturned on appeal.

The CMS statistics are misleading

The full Medicare appeals process involves 5 steps: (1) a request for Redetermination, (2) a request for Reconsideration, (3) an appeal to an ALJ, (4) an appeal to the Medicare Appeals Council and finally (5) an appeal to Federal District Court. The entire process can take well over two years to complete.

The problem with the statistics in CMS’ June 2012 report is that it compares repayment demands made in FY 2011 with the result of appeals from repayment demands made in other fiscal years. So, for example, some portion of the 24,548 favorable decisions included in the report are from appeals of repayment demands made in earlier fiscal years, while not included in the number are FY 2011 appeals not yet decided. Similarly, the figure for claims not appealed does not fully reflect, for example, appeals that may not be filed until November or December, 2011 of repayment demands made in August or September 2011. In short, the appeals statistics are useless.

In order to obtain valid statistics, CMS must identify a group of repayment demands, either those issued in a month or in a fiscal year or for any other period CMS chooses. CMS then must identify all of the claims appealed from that period and track that identified discrete group of appealed claims through each level of the appeal process. Only then will it be possible to reach a valid conclusion as to whether the RAC’s contingent payment arrangement is affecting the results of their audits. Statistics kept in this manner will also be useful in assessing the effectiveness of each level of appeal in correcting RAC errors.

Please contact us if we can be of any assistance in analyzing any of the various Medicare-Medicaid Audit World statistics or in helping to resolve an issue with any of the CMS legion of auditors.

Medicare-Medicaid Audit World

Medicare-Medicaid Audit World